Strengthening Futures Through Financial Wisdom and Digital Inclusion

Financial empowerment

Financial Linkages

Digital Inclusion

AI Adoption

Financial empowerment

Financial Linkages

Digital Inclusion

AI Adoption

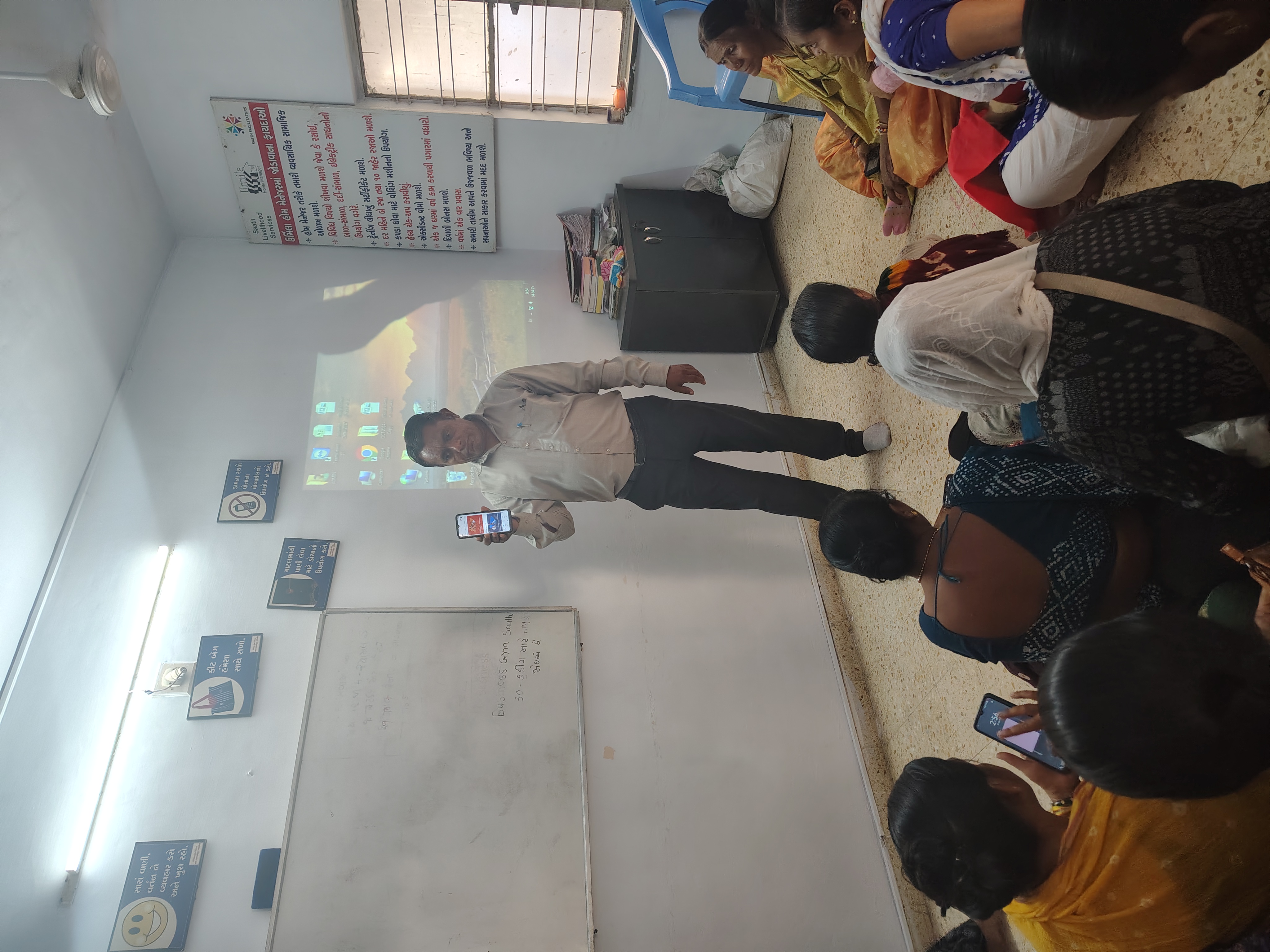

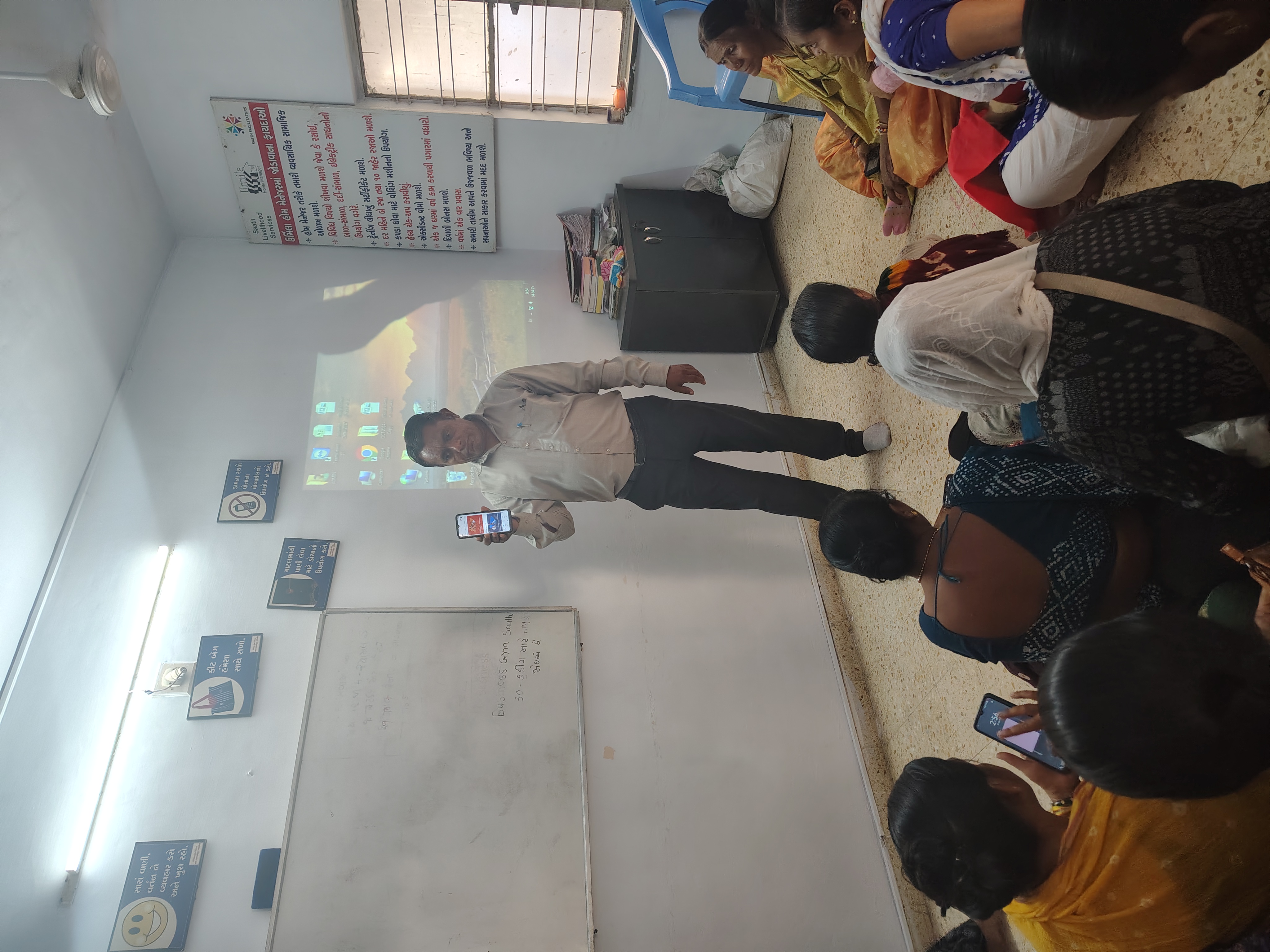

Financial and digital empowerment has become one of the key objective for Saath in recent Times. We have been equipping marginalized communities with the tools needed for long-term security, informed decision-making, and economic opportunity.

All our programs incorporate financial and digital literacy components, enabling individuals to access essential services, navigate digital platforms with confidence, and make sound financial choices.

Since 1994, we have nurtured a culture of saving through community-led groups, eventually establishing the Saath Savings and Credit Cooperative Society to cater to informal sector workers who remain outside the reach of formal financial institutions.

As part of its digital and financial literacy efforts, we also work to raise awareness about cybercrime and educate communities on safe digital practices to protect their personal and financial data online.

These integrated efforts collectively strengthen economic resilience, encourage positive financial behaviors, and advance digital inclusion at the household level.

People educated

Financial inclusion and linkages & fraud

Workshops held

Financial wellbeing, linkages & Fraud awareness

Digital account management system

Since 1989, we at Saath Charitable Trust have been working to transform slums into vibrant neighborhoods through our Integrated Community Development Programme. Understanding that poverty is complex and deeply rooted, we adopted a multipronged approach—one key aspect being the provision of community-based financial services for urban poor families who had little to no access to formal banking.

We saw firsthand that in many urban settlements, families—especially women—worked hard but were forced to rely on high-interest moneylenders due to the absence of savings habits, inaccessible banks, and lack of proper documentation. It became clear to us that financial discipline couldn’t be built through lectures alone. What was truly needed was a trust-based, community-rooted system that encouraged saving and provided fair access to credit.

In low-income urban settlements, financial distress is an increasingly common crisis. Many families fall prey to cyber fraud, predatory lending, and fraudulent schemes due to lack of financial awareness, limited access to formal banking, and social pressures to invest in risky ventures. Alarming data shows a sharp rise in distress calls related to financial losses—indicating a growing need for support in managing money, protecting assets, and planning for the future. The absence of localized financial advice and legal recourse further deepens the vulnerability of these communities. There is a clear need to build community-level infrastructure that can provide trusted, practical, and proactive financial guidance.

What Has Been Its Impact :